India’s Paytm introduced the innovative sound box, a pocket-sized speaker designed to instantly validate and announce successful payments to merchants. It has deployed million of these devices to the market, offering them to merchants at just above $1 monthly. India’s largest company is paying attention.

Reliance has been testing a sound box with employees at some of its stores in its campus in recent weeks, according to a person familiar with the matter.

The device uses Jio Pay as the reconciler, the person said, requesting anonymity speaking on nonpublic matters. The firm, run by Mukesh Ambani, has a tradition of internally testing new offerings with its staff before a public launch. But how soon, if at all, it plans to unveil the device remains unclear. It didn’t respond to a request for comment.

The sound box, whose bill of materials cost less than $20, is rapidly becoming an emblem of digital transactions in various Indian retail settings. Its audible confirmation feature is particularly popular in marketplaces and cacophonous street corners, instilling trust and confidence in both sellers and buyers regarding payments transactions.

Moreover, the sound box has evolved into a lucrative subscription model over time as companies like Paytm and the Walmart-backed PhonePe impose nominal subscription charges on merchants. The real allure of the sound box extends beyond its auditory alerts – it provides invaluable insights into merchant behaviors, facilitating the offering of loans based on this data.

No wonder then that scores of companies including large banks HDFC, ICICI and Google have launched or tested their own sound boxes in recent quarters.

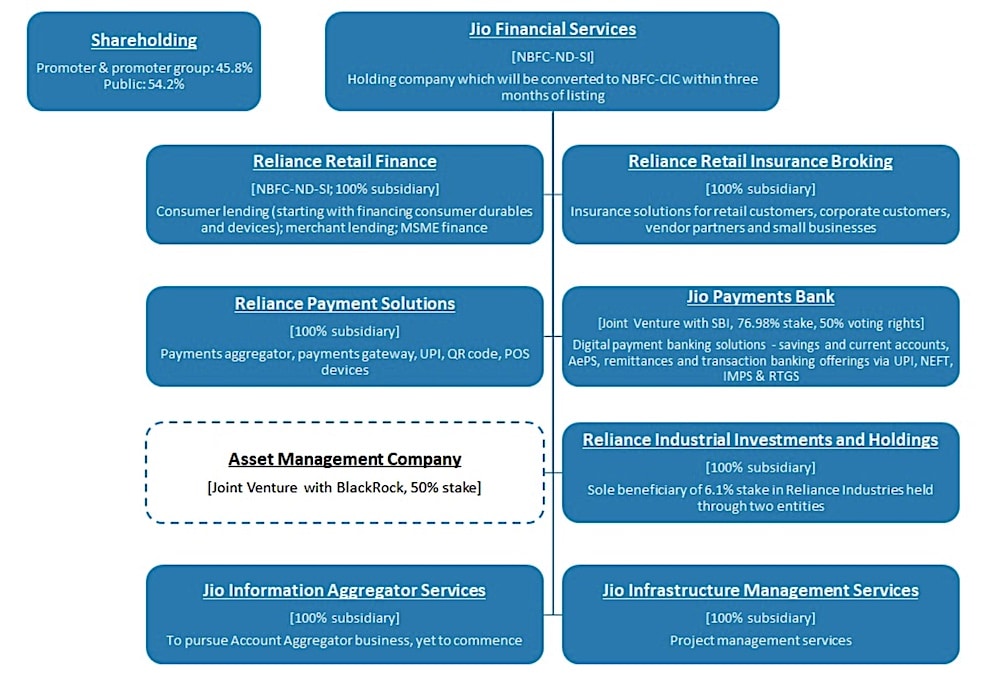

Jio Financial Services maze (Image: Morgan Stanley)

Reliance’s interest in the business comes as a time when its financial services unit, Jio Financial Services, is looking to expand to more businesses. The firm, which currently offers no services but has unveiled plans to offer a wealth management service in partnership with BlackRock, plans to expand to merchant lending.

“The merchant lending business will provide trade credit, personal loans, store improvement loans, and unsecured business loans. The MSME finance business will offer working capital funding needs for suppliers and distributors. All three verticals will adopt a digital-first, tech-led business model,” Morgan Stanley analysts wrote in a report this week.

If Reliance ventures into the business, it has a distinct advantage: The company can access capital at more affordable rates than many of its Indian counterparts.

Go to Source

Manish Singh